Did you know that choosing the right pricing strategy for new product launches can increase your margins by up to 60%?

Setting the right price is one of your most critical decisions for a new product launch. Too high, and customers walk away. Too low, and profits vanish. A mere 1% improvement in price can lead to an 11% increase in operating profits.

Price optimization helps you set the right price for your products to maximize profitability. Setting a price point that makes your product appealing while keeping healthy margins can be challenging. Companies that use customer-centric pricing strategies have increased gross profit by 5% to 10% and sustainably increased revenue.

The global market for price optimization and management keeps growing faster. It should reach $2.0 billion by 2027 with a 12.7% growth rate. This shows how vital effective pricing strategies for new products are in today’s competitive world.

In this piece, you’ll find eight proven new product pricing strategies that can turn your launch from successful to exceptionally profitable. You’ll learn to review which pricing approach matches your business goals, make use of information, and implement testing methods that ensure you maximize both customer acquisition and long-term profitability.

Ready to tap into the full profit potential of your next product launch? Let’s take a closer look at the expert strategies that will help you set the

Perfect price.

Why Pricing Strategy Matters in a New Product Launch

“”Price is what you pay. Value is what you get.”” — Warren Buffett, Chairman and CEO of Berkshire Hathaway, legendary

investor

A new product’s pricing strategy goes beyond just picking numbers. Your product’s market success depends on the foundation you build with your launch pricing decisions.

The impact of first impressions on pricing

“You never get a second chance to make a first impression.” This saying rings true for new product pricing. The price point you choose creates an instant and lasting image of your product’s value in your customers’ minds. Your product’s positive first impression hinges on the right price.

Your new product’s pricing strategy carries lasting effects. The launch phase gives you one chance to make that vital first impression with your target audience. Your original pricing decision shapes how people see your product:

- High initial pricing can make your product seem premium and signal better quality with exclusive benefits

- Low initial pricing might make your product more available but could tag it as a basic offering forever

People buy new products differently than familiar ones. They think more and rely less on instinct. So, customers will likely stick to what they know unless they can easily see how your pricing lines up with the value you offer.

A recent global analysis of 44,000 brands by Kantar BrandZ found that 34% of brands failed to back up their perceived price. These brands faced the biggest risks when consumers had to choose where to spend money, especially during tough economic times.

How pricing affects long-term profitability

Your pricing strategy shapes more than first impressions. It affects your product’s financial future. Each product gives you a chance to influence sales, price perception, market position and profits.

Harvard studies show that improving your pricing by just 1% can boost overall profits by up to 11%. McKinsey & Company’s research reveals that a 1% price increase could lift operating profit by 8%, if sales stay the same. These numbers show why pricing decisions need careful thought.

Your original pricing choices affect profits throughout the product lifecycle:

- During introduction: Prices should help recover development costs while gaining market share

- Growth phase: Pricing changes to boost revenue as demand grows

- Maturity stage: The focus moves to maximizing profits as growth slows down

- Decline phase: The goal becomes getting remaining value from shrinking sales

Setting the right launch price can reset what people expect to pay and improve your product’s profit path. This takes looking at different pricing models, how customers and competitors might react, and what it means for earnings.

Low launch prices leave little room for future promotions or markdowns. High prices give better per-unit margins but might limit total revenue. A good pricing strategy makes your product appealing while keeping your business healthy long-term.

Your pricing strategy for new product success means more than setting numbers. You just need a complete approach that matches your business goals, market conditions, and what customers want. Your launch decisions will shape both immediate sales and your product’s financial future.

Key Factors That Influence New Product Pricing

Setting the right price for your new product needs a solid grasp of several key market forces. Your pricing decisions must balance multiple competing factors to hit that sweet spot where profits meet market acceptance. Let’s get into the most powerful factors that shape an effective pricing strategy for new product launches.

Market maturity and competition

The competitive scene shapes how you should price your product. Markets with many competitors selling similar products make customers more sensitive to price. To name just one example, launching a new beverage alongside 5- year old brands means pricing above competitors will likely face resistance from consumers.

Markets with unique products and fewer alternatives show lower price sensitivity. You’ll have more room to adjust your pricing, especially when your product shows clear quality differences.

Your pricing options change based on whether the market is monopolistic, duopolistic, or oligopolistic. About 60% of competitive pricing studies look at duopolies, while all but one of these studies examine oligopolies. These competitive markets make price information easy to find. Customers become more aware of price differences since they can compare options online or through apps.

Smart competitor-based pricing needs three basic elements:

- Deep market research to know customer needs and price ranges

- Regular tracking of competitor pricing patterns and positioning

- Price adjustments based on useful competitive data

Ignoring competitors when pricing can backfire—research shows competition-based variables explained 30.2% of price changes in one study, compared to 22.3% from demand-side variables.

Customer demand and price sensitivity

Price sensitivity shows how price changes affect product demand. Understanding this relationship often separates businesses that attract loyal customers from those that lose them to competitors.

Several factors substantially affect price sensitivity:

- Income levels: Lower-income consumers watch prices more closely than those with higher incomes

- Age demographics: Young professionals starting their careers pay more attention to prices than established professionals with extra income

- Perceived value: Customers become less worried about price when they see unique or exceptional quality

- Brand loyalty: Loyal customers often accept higher prices because they feel connected to your brand

- Necessity: Customer’s price sensitivity drops when they just need your product, like prescription drugs without alternatives

Economic conditions like recessions or inflation can make everyone more price-conscious, whatever their usual buying habits. These tough times might push even loyal customers toward cheaper options despite their usual priorities.

Production and distribution costs

Your product’s creation and delivery costs set the basic “floor price”—you can’t go below this without losing money. The best price lets you earn maximum profit while fitting your business situation.

Production costs include all direct and indirect expenses needed to make your product: raw materials, labor, manufacturing overhead, and distribution. A bakery spending $100 to make bread might price it at $160 to cover costs and keep healthy profits.

Production comes with fixed costs like equipment and salaries that stay the same no matter what, plus variable costs such as utilities and materials that change with production levels. The cost of making one more unit becomes vital as you grow. Economic theory suggests businesses should keep producing until that extra unit’s cost matches its revenue.

These complex relationships mean your new product pricing strategy must cover costs while staying competitive. Cost-plus pricing adds a fixed profit margin to costs, but it has one big drawback—it forgets about the customer.

Finding this balance reshapes the scene from good to excellent pricing that maximizes both market share and profits.

8 Proven Pricing Strategies for New Products

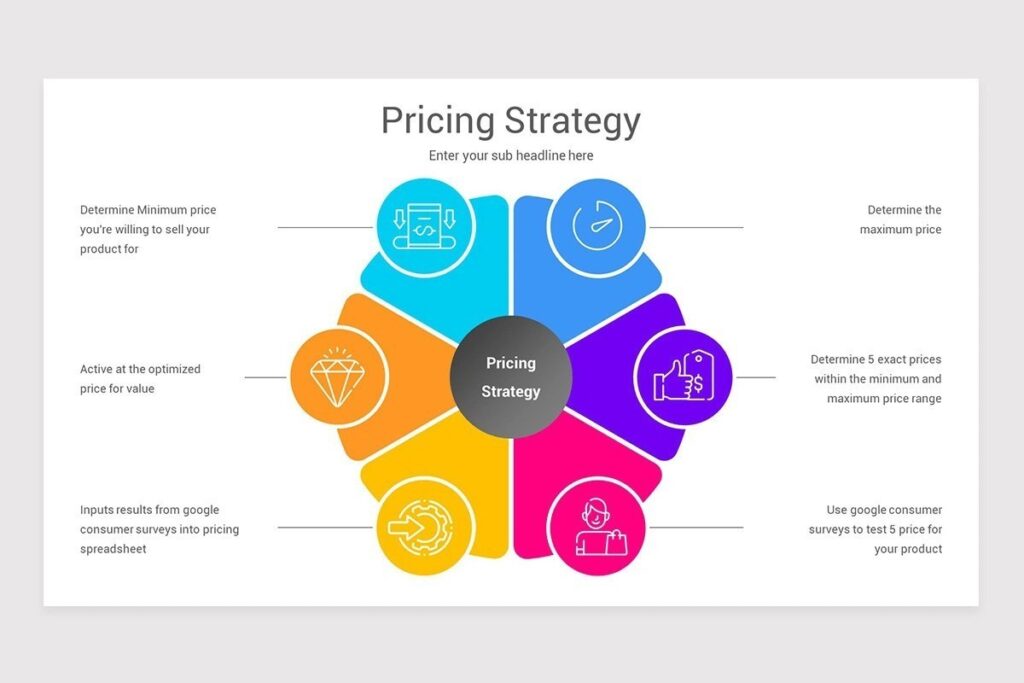

Image Source: Nulivo Market

The right pricing strategy for new product launches can determine if your product dominates the market or fails. You have several ways to price your product, and picking one that matches your business goals is vital to get the most market share and profits.

1. Price Skimming

Price skimming starts with high prices for your innovative product and lowers them as time passes. This works well when you target early adopters who don’t mind paying more to be first. You can adjust prices down to attract budget- conscious buyers once early adopters have bought in and competition grows. Apple shows how this works—they price new iPhones high at launch, then drop prices when newer models come out. This strategy shines with products that people see as valuable or innovative, where early buyers care less about price.

2. Penetration Pricing

Unlike skimming, penetration pricing starts with very low prices to grab market share faster. This bold move pulls customers away from competitors, with plans to raise prices once you’re established. Uber used this approach to compete with local taxis, though it took until 2023 to make a profit. You can lead the market this way and build customer loyalty—people try your product because it’s cheap, and they stick around if it’s good, even after price increases.

3. Bundle Pricing

Bundle pricing puts several products or services together at a better price than buying them one by one. Customers see more value, and you sell more while making buying decisions easier. McDonald’s Extra Value Meals show this perfectly—you pay less for a burger, fries, and drink combo than if you bought each item separately. This works great with products that go together, SaaS subscriptions, and custom service packages.

4. Freemium Pricing

Freemium gives away simple features and charges for premium ones. Internet startups and app developers have loved this approach in the last decade. Spotify nails this—you can listen free with ads and basic features, or pay for premium service without interruptions and extra perks. This works best when your free version draws lots of users who want to upgrade. All the same, only 5-10% of free users typically switch to paid versions.

5. Premium Pricing

Premium pricing sets your prices higher than competitors to show better quality and exclusivity. Brands known for top- quality products or unique features do well with this. Apple leads here too, charging more than others for similar products. You get better profit margins, a stronger brand image, and compete on quality instead of price.

6. Dynamic Pricing

Dynamic pricing changes prices based on what’s happening in the market right now, looking at demand, supply, competition, and how customers behave. Companies use this to make more money by matching market conditions— prices go up when demand is high and down when it falls. Airlines do this well by changing ticket prices based on demand, time until takeoff, and what competitors charge.

7. Cost-Plus Pricing

Cost-plus pricing adds a set percentage to what it costs to make your product. The math is simple: multiply your total production cost by one plus your target profit percentage. Many clothing and cosmetic retailers use this because they have lots of different products and can add different markups based on production costs. While experts often criticize it, cost-plus pricing remains the most common way to set prices across industries.

8. Captive Product Pricing

Captive product pricing makes little profit on the main product but charges more for must-have extras. Printer companies sell printers cheap but charge a lot for ink cartridges. Coffee machine makers do the same—affordable machines but pricey coffee pods. This creates steady income from add-on products and helps keep customers coming back.

How to Choose the Best Pricing Strategy for Your Product

“”Pricing is actually pretty simple. Customers will not pay literally a penny more than the true value of the product.”” — Ron Johnson, Former CEO of J.C. Penney, architect of Apple’s retail stores

A winning **pricing strategy for new product** launches just needs careful analysis of several connected factors. You must think over how your pricing decisions will support your broader business ambitions, target the right customers, and balance immediate sales with long-term profitability.

Arranging pricing with business goals

Your pricing approach should directly support your company’s overall strategic direction. Here are some simple questions to guide your decision:

- Are you prioritizing rapid market penetration or premium positioning?

- Do you just need to quickly recover development costs or build long-term customer relationships?

Should you maximize profit margins or grow market share?

Companies aiming for high margins might prefer value-based or skimming strategies, while those focused on growth typically choose penetration or competitive pricing. To cite an instance, SaaS businesses pursuing customer acquisition often use a resilient, free or low-cost base tier. This provides enough value to attract a wide audience while ensuring premium features add value that encourages upgrades.

If your main goal is maximizing average contract value, provide simple functionality at the base tier. Design clear upgrade paths that show meaningful differences between tiers.

Evaluating product uniqueness and value

Price expresses value. Customers naturally link your product’s worth with its pricing. They perform what you might call “value-math” in their minds. Your pricing should help showcase your product’s uniqueness and answer a key question: “Is this product worth it?”

Products that stand out from competitors with distinctive benefits can benefit from prices based on what customers truly believe they’re worth. Value-based pricing helps you match what customers will pay while learning more about what they really want.

Yes, it is true that well-executed value-based pricing creates better arrangement between your customer, your value, and your price.

Customer acquisition vs. profit

The balance between customer acquisition and profitability is one of the toughest challenges executives face. Aggressive pricing can boost customer acquisition but might hurt long-term profitability. Premium pricing could improve margins but slow growth by limiting market reach.

Two key metrics help balance these competing priorities:

- LTV:CAC Ratio: Shows customer lifetime value against acquisition cost. Top-performing companies maintain a 3:1 ratio or higher.

- CAC Payback Period: Shows how many months it takes to recover customer acquisition costs. Healthy businesses recover CAC within 12-18 months.

Note that your pricing relative to acquisition costs should reflect your market position. Market leaders with strong brand recognition usually have lower CAC and can charge premium prices. Challengers might accept higher CAC relative to pricing to gain market share.

Using Data and Tools to Set the Right Price

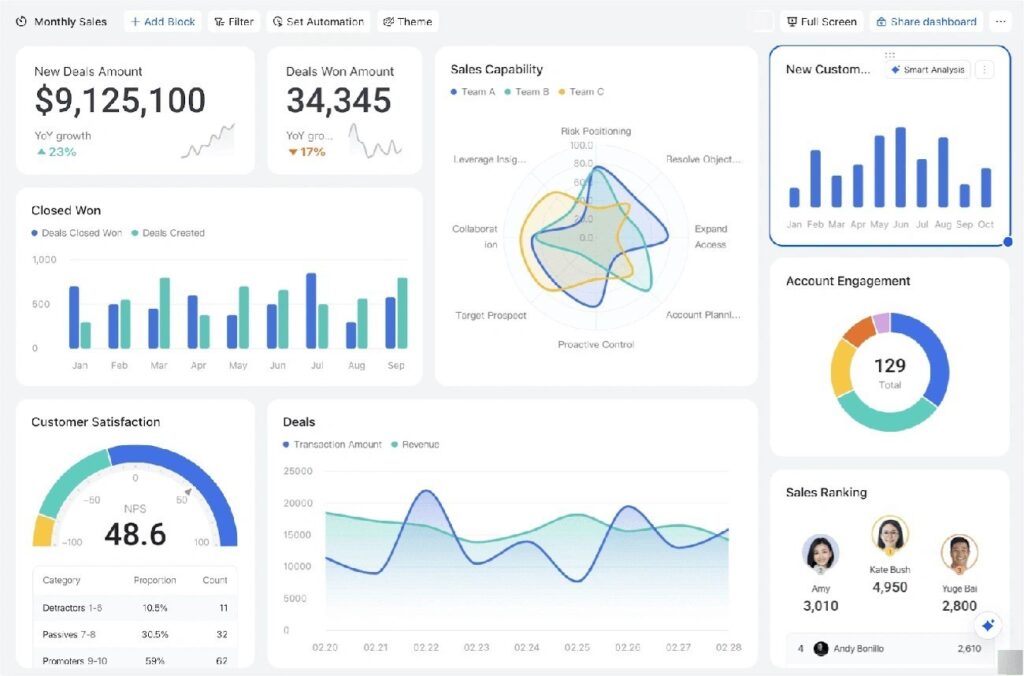

Image Source: Lark

Data-driven pricing stands as a vital asset that helps maximize your new product’s profitability from the start. The right data builds confidence in pricing decisions rather than relying on gut feelings or guesswork.

Using historical and competitor data effectively

Past sales data provides a wealth of information about customer behaviors, market dynamics, and seasonal trends. Sales information analysis helps you learn about pricing opportunities and customer buying patterns. To name just one example, perusing historical pricing data might show customers who gladly pay premium prices during certain seasons.

Best results come from:

- Getting detailed data from multiple sources like sales records and market reports

- Breaking down your data into manageable units to spot micro-markets and product sets

- Finding pricing outliers since they often show quick opportunities to raise prices

Competitor price tracking will give an accurate view of your market position. A grocery chain found their prices were 20-30% lower than competitors and raised them just below competition levels. This improved margins without much effect on volume.

AI and pricing software benefits

Manual analysis of thousands of data points across many spreadsheets proves impossible. AI-powered pricing tools now process big datasets to spot patterns and predict future pricing scenarios accurately.

These smart tools help with:

- Immediate price adjustments based on demand and competitor moves

- Tailored pricing through customer browsing patterns and purchase history analysis

Price elasticity studies to track how changes affect market demand

Examples of pricing optimization tools

Several powerful platforms reshape the scene for your pricing strategy for new product launches. Amazon Web Services, Pricefx, and Qualtrics offer trailblazing solutions for businesses of all sizes. Download our small business calculator to see how different pricing strategies affect your specific revenue projections.

SYMSON lets you compare competitor prices, analyze data, and suggest new prices within minutes. Better yet, some platforms predict future scenarios and demand. This helps you prepare proactively instead of just reacting to market changes.

Testing, Monitoring, and Adjusting Your Pricing

The best pricing strategy for new product launches needs tweaking after market debut. Companies that stay flexible with pricing do better than those with fixed rates. Your original price should serve as a starting point you can adjust later.

A/B testing different price points

You can find the right price through scientific A/B testing experiments. Revenue matters more than conversion rates when you test prices. More customers might come with lower prices, but profits could suffer—measure what truly counts for your business goals.

Here’s how to run effective A/B tests:

- Create clear predictions about customer reactions to price changes

Set up organized tests with control groups

- Get enough data to reach solid conclusions

- Take a full look at results before making changes

Never show different prices for similar products at once—customers might lose trust and legal issues could arise. The better approach is to test various value offers at different price points. Give slightly different features to justify price differences.

Tracking customer behavior and feedback

Customer feedback offers great ways to learn about how people view your pricing. Sales data and direct customer input help confirm your new product pricing strategy after launch. Watch out for:

- Comments comparing value and price

- What people say about competitors in reviews

- How different customer groups respond to purchases

This feedback serves as the life-blood of smart business moves. It shows real data about market trends and what customers want. Remember to tell customers when you make changes based on their input—they’ll appreciate knowing their voice matters.

When and how to adjust pricing post-launch

Prices shouldn’t stay fixed forever. Keep an eye on market changes, demand shifts, what competitors do, and cost changes. Download our small business calculator to see how price changes could boost your profits.

Smart ways to adjust pricing:

- Make changes during quiet business periods

- Show clear value when you announce new prices

- Think about keeping old rates for existing customers if prices go up

Testing regularly gets the best results. Look at Spotify—they test pricing tiers often and get more users because of it. This ongoing fine-tuning keeps prices competitive and profitable throughout your product’s life.

Conclusion

The right pricing strategy for your new product is one of the most crucial decisions you’ll make during a product launch. This piece shows how strategic pricing can affect both first impressions and long-term profitability. A small 1% improvement in pricing can boost operating profits by 11%. This shows how vital pricing is to your launch strategy.

You’ve learned about eight proven pricing approaches—from skimming to penetration pricing, from freemium to dynamic pricing. Now you know how to pick a strategy that works best with your business goals. Market maturity, customer needs, and production costs shape your pricing decisions.

Data is your best friend when setting the right price points. Collecting competitor information, making use of information from AI-powered pricing tools, and using structured testing methods will improve your pricing accuracy. These methods help you adapt quickly as market conditions change.

Price setting isn’t a static process. You should always watch customer behavior, track market changes, and tweak your approach based on what you see. Successful companies see pricing as an ongoing experiment rather than a one-time choice.

Your pricing strategy for new products will decide if you just survive or thrive in today’s competitive market. Take a good look at your situation, use the frameworks we’ve covered, and test different approaches before you lock in your strategy.

Want to turn your pricing approach into a profit-generating engine? Our Pricing Pulse Audit helps you find hidden revenue opportunities and optimize your pricing strategy based on your market position. Start boosting your customer acquisition and profitability today.