Bruce Springsteen concert tickets once hit $4,000. This shocking price tag expresses why pricing ethics has become a critical business concern today.

Dynamic pricing lets businesses adjust prices as demand changes. This can maximize revenue during peak demand periods. But customers often see such practices as profit gouging. The practice has its benefits – it helps match customers with products at the right price. The business ethics question still remains: how do you balance profit optimization with fairness?

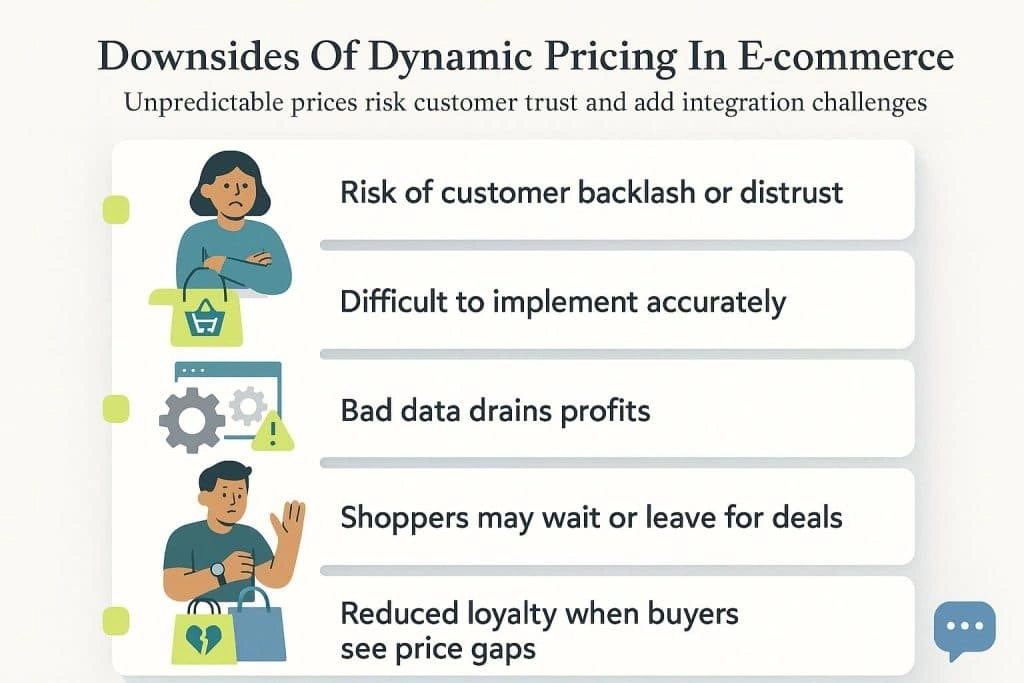

Dynamic pricing brings automation and evidence-based processes. Yet it creates its own set of challenges. Businesses just need strategies that tap into market demand without pushing customers away. New technology and growing data availability make innovative pricing approaches possible.

In this piece, you’ll learn to implement dynamic pricing ethically. This can turn a risky customer relations situation into a competitive edge that adds value to your product catalog.

What is Dynamic Pricing and Why It Matters

Image Source: Business.com

Dynamic pricing marks the most important change from traditional fixed-price models. Businesses can adjust their prices based on immediate data about demand changes, competitive positioning, and market conditions.

Dynamic pricing definition and how it works

Dynamic pricing lets companies adjust their product or service prices based on immediate data analysis. Unlike static pricing that keeps prices constant over time, dynamic pricing uses advanced algorithms to analyze several critical factors:

- Current demand levels

- Competitor pricing strategies

- Inventory availability

- Customer behavior patterns

- Market conditions

These algorithms process big amounts of data to find the best pricing that maximizes revenue while staying competitive. Dynamic pricing equips organizations to respond to changes right away and deliver value to customers while they retain control over profitability.

Dynamic pricing vs variable pricing

People often mix them up, but dynamic and variable pricing are two different approaches. Variable pricing uses flexible pricing structures but is different in how it works:

Dynamic pricing changes prices based on immediate market conditions, while variable pricing sets different prices before products go on sale. Products with variable pricing keep their set prices until someone manually changes them.

The biggest difference is how often prices change—dynamic pricing updates continuously (sometimes within minutes), while variable pricing stays the same for set periods. Dynamic pricing also needs more advanced technology and data analysis tools.

Why businesses are adopting it now

Technology advances have led to rapid growth in dynamic pricing adoption. In the past, few companies had the data, expertise, or systems they needed to change prices effectively. Now, sophisticated algorithms and data analysis tools are accessible to more people.

Companies now know that old static pricing models can’t keep up with today’s complex markets. Economic uncertainty, changing supply and demand patterns, and higher customer expectations make adaptability crucial to stay competitive.

Dynamic pricing brings clear benefits: it keeps prices stable during market changes, prevents lost sales from wrong pricing, and helps companies make more money during peak demand. Companies can stay strong and accelerate growth even when markets become unpredictable.

The Ethical Dilemma in Dynamic Pricing

Image Source: FasterCapital

Customers deeply distrust algorithmic pricing. Research shows 68% of consumers report they feel taken advantage of when businesses use dynamic pricing. This customer skepticism poses challenges even for well-planned pricing models and creates a disconnect between business strategy and what consumers will accept.

Understanding customer resistance

People resist these pricing models because they seem unfair. Research reveals that 80% of consumers trust brands more when they keep prices consistent. This shows the tension between making more money and keeping customers happy. 22% of Americans would avoid spending money at businesses that use dynamic pricing, which suggests strong market pushback. People care more about social factors and fairness than they do about how sophisticated the pricing technology is.

Examples of pricing backlash in real life

Real-life examples show what happens when dynamic pricing goes wrong. Wendy’s learned this lesson the hard way after announcing plans to test prices based on time of day. The backlash was immediate, and they had to explain they wanted to offer discounts during quiet times rather than raise prices during busy periods. Uber faced the same problem with surge pricing during emergencies. They ended up putting caps on fares during emergency situations. These cases show how pricing decisions can damage a brand’s reputation faster when customers see them as unfair.

The role of business ethics in pricing decisions

The ethics of pricing comes down to balancing two main ideas:

- Shareholder Theory: This approach aims to maximize profits and follows outcome- based ethics where results justify methods

- Stakeholder Theory: This focuses on being fair and open with everyone involved

Studies show that doing the right thing pays off—companies with 10-year old codes of ethics tend to make more money than average. So ethical pricing needs clear explanations of how prices work, fair treatment during emergencies, and special care for vulnerable customers.

As computers take over more pricing decisions, managers now focus on picking algorithms instead of setting prices. This makes ethical choices even more complex but vital for long- term success.

How to Make Dynamic Pricing Fair and Transparent

Ethical dynamic pricing relies on transparency as its foundation. An MIT study revealed that 87% of consumers view dynamic pricing negatively if not implemented transparently. This finding emphasizes why fairness matters so much.

Be upfront about pricing logic

Your pricing decisions should be clear to build customer confidence. Customers tend to complete more purchases if they understand price variations based on timing, market conditions, or demand. This clarity reduces cancelations caused by unexpected costs. Companies like KoRo show this well. They announce price changes through their blog posts and provide clear explanations, regardless of whether prices go up or down.

Avoid hidden fees and clickbait pricing

The FTC requires businesses to show the “total price” upfront in advertisements, which includes all mandatory fees. Vague descriptions like “convenience fee” or “service fee” need specific explanations. Studies show customers respond poorly to unexplained price variations.

Use product bundling to add value

Clear package options like Basic, Pro, and Enterprise help reduce decision fatigue and showcase value better. Price increases become more acceptable to customers if you offer something extra in return, such as enhanced service agreements.

Communicate price changes clearly

Price changes need advance notice – at least a month ahead works best. This timeline lets customers plan their finances better. Research shows that direct explanations about price increases, especially those linked to rising costs or better services, make customers view pricing as fairer.

Best Practices to Implement Ethical Dynamic Pricing

Image Source: FasterCapital

Dynamic pricing works best when businesses balance profits with fair treatment of customers. Your team should set clear guardrails that define minimum and maximum price thresholds.

Segment customers and tailor pricing

Smart customer grouping depends on buying patterns, loyalty levels, and specific needs. This method helps you grasp how much different groups will pay, which leads to customized pricing that boosts both customer happiness and profit margins. Studies reveal a targeted 1% price increase can boost your bottom line by 12.7%.

Test and iterate with live data

Research shows businesses should update their pricing strategy every 6-9 months to stay competitive. The best approach tests new methods with smaller customer groups first. Your team should gather and study customer feedback, market position, and industry trends to fine-tune pricing calculations.

Train internal teams on pricing ethics

Staff members need proper education about fair pricing and upcoming regulatory shifts. This knowledge helps everyone apply ethical rules the same way. The core team must understand both the technical side of pricing and its ethical limits.

Line up pricing with long-term brand trust

Research proves trust drives business results: 85% of customers recommend companies they trust, 83% stay loyal to trusted brands, 74% buy more products, and 66% pay premium prices for trusted brands. Download our free small business pricing calculator to help balance profit optimization with ethical considerations.

Conclusion

Dynamic pricing brings both opportunities and challenges to modern businesses. This piece shows how live price adjustments can maximize revenue but might create friction with customers. Success depends on finding the sweet spot between profit optimization and what customers see as fair.

Customer trust matters above everything else. Research shows that 80% of consumers trust brands with consistent pricing more, which makes transparent pricing a must-have rather than just an option. Your pricing strategy needs to match your brand values to build lasting customer relationships.

Ethics should drive every pricing decision. Clear guidelines, proper customer segmentation, regular testing, and team training in ethical standards all help create responsible dynamic pricing. The strategy also works better when you explain your pricing logic clearly so customers focus on value instead of just cost.

Companies that can adjust pricing strategies while keeping customer trust will lead the future. Dynamic pricing tools can optimize revenue powerfully, but your approach must put transparency and fairness first. A pricing strategy loses all value if it hurts your brand’s reputation.

Dynamic pricing works best when customers feel valued rather than used. Your pricing approach should create situations where customers get fair value and your business earns

appropriate returns. With careful implementation based on ethical principles, dynamic pricing becomes a lasting competitive edge rather than a problem for customer relations.