Custom pricing creates stronger negative emotions than most commercial practices when customers see it as unfair. Behavioral economics research shows that fairness perception shapes how customers react to personalized pricing strategies.

Companies using individualized pricing models see varied results among different consumer groups. A newer study reveals an interesting twist – personalized pricing helps consumers who buy common goods. The same approach hurts those who purchase niche products with fewer buyers. This creates a tricky situation for businesses that need to balance profits and customer trust.

Consumer behavior shows dramatic shifts, with 68% of people reducing their spending to improve their financial habits. Markets with complete price transparency face unique challenges. Price differences can make customers feel unfairly treated, lose trust, and become less likely to buy. Nobel laureate Daniel Kahneman’s research proves that people often turn down profitable deals they consider unfair.

The modern world of dynamic pricing systems needs careful handling. Businesses must know how to build and keep customer confidence. This piece breaks down personalized pricing mechanics, customer reactions, and practical ways to create fair systems that keep trust while maximizing revenue.

The Shift from Fixed to Personalized Pricing Models

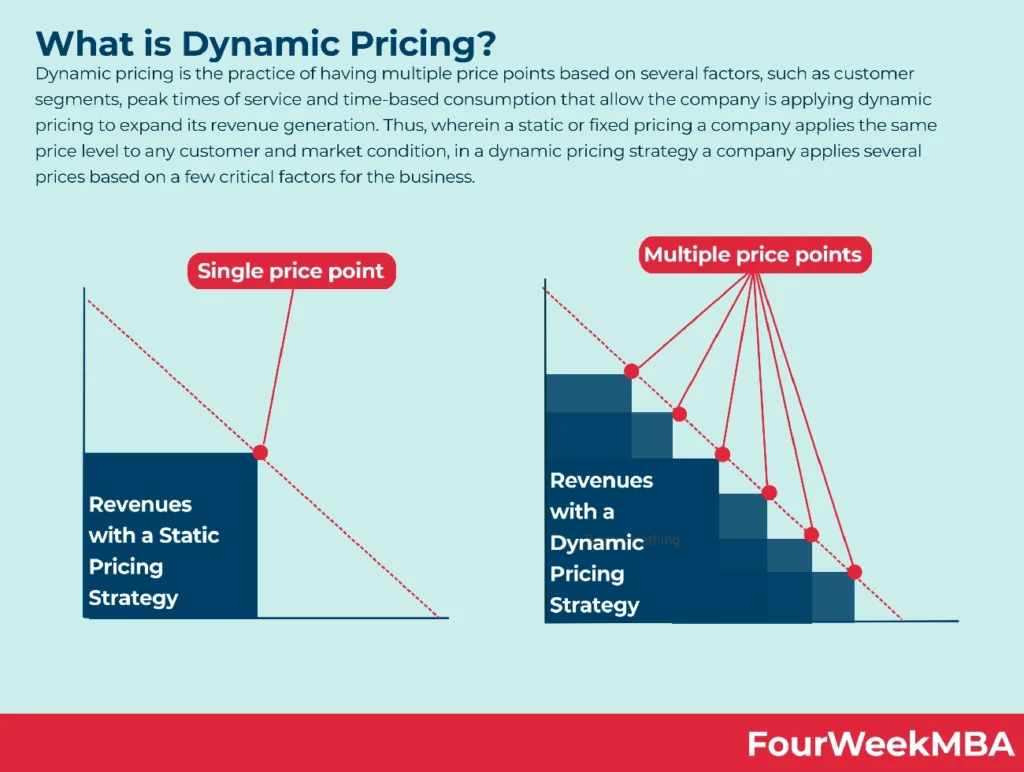

Image Source: FourWeekMBA

Personalized pricing shows a fundamental change in how businesses value their products. Traditional fixed pricing has given way to algorithms that set different prices for similar products based on each customer’s characteristics. These systems look at your purchase history, location, browsing behavior, and how much you might pay.

What is personalized pricing and how it works

Smart algorithms process huge amounts of customer data to make personalized pricing work. Companies gather information from many sources like browsing patterns and purchase history. Machine learning tools then analyze this data to spot patterns and group customers. The system adjusts prices live to create tailored experiences for each customer.

The system is different from dynamic pricing, which changes prices based on market conditions rather than individual profiles. Algorithmic pricing helps businesses to “automate the setting of prices” as market conditions change. These systems make millions of pricing decisions each day.

Examples of customized pricing in online retail

Amazon leads the way in personalized pricing strategies. They change product prices every 10 minutes on average, which means 144 price changes daily for one item. Online travel agencies like Booking.com use customer data and AI algorithms to set room rates. Prices change based on factors like device type and booking history.

Ride-sharing platforms like Uber and Lyft use personalized pricing through surge pricing. They adjust fares based on live demand and supply. Streaming services also offer custom subscription rates based on how people use their service.

Historical context: From price tags to algorithmic pricing

Retail goods had no fixed prices before the late 19th century. Customers had to haggle with store clerks. John Wanamaker introduced price tags in Philadelphia in 1874. Quakers believed charging different prices to different customers was wrong.

Fixed pricing ruled retail for almost 150 years until airlines pioneered modern algorithmic pricing. Other industries followed their success. We’ve now come full circle – moving from haggling to fixed prices and back to variable pricing. The only difference is today’s unprecedented tech sophistication.

Consumer Reactions to Individual Pricing Strategies

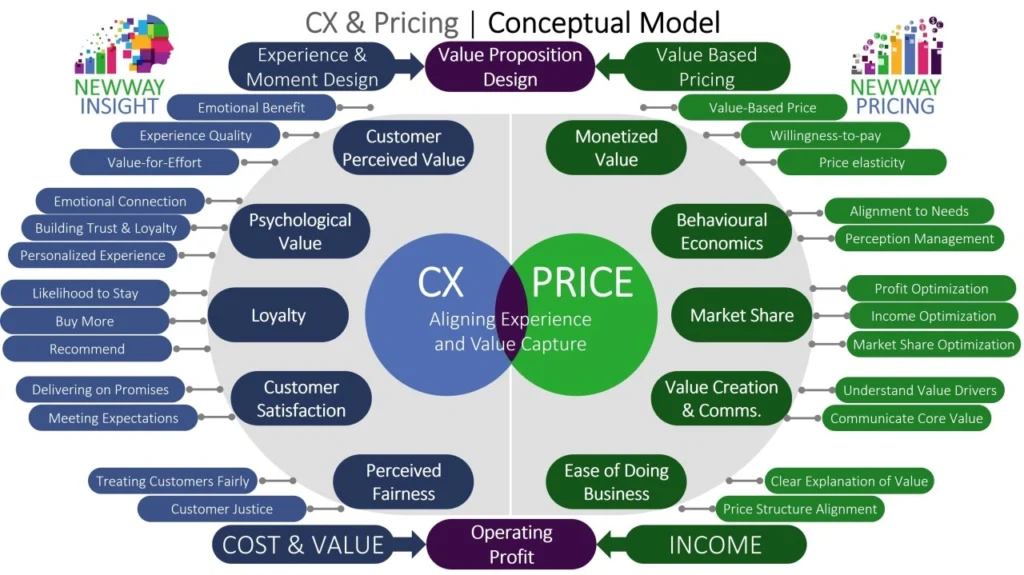

Image Source: LinkedIn

Research shows that consumers strongly oppose customized pricing when they notice it as unfair. People believe prices should stay stable despite market changes. Only 33% accept price increases even when production costs go up.

Perceived fairness and inequity aversion in pricing

Consumers show inequity aversion—a psychological resistance to unequal outcomes—when they see different pricing. Economic models have formalized this concept that explains why people reject personalized pricing creating gaps between customers.

About 29% of consumers just need more clarity in price calculations. Amazon’s implementation of personalized pricing based on purchase history triggered substantial consumer backlash. The company had to issue refunds and drop the strategy.

Impact of price transparency on trust

Consumer confidence in pricing systems depends on transparency. A study of 2,000 American shoppers found unclear price increases as their biggest worry. Unexplained price changes often make customers switch brands. About 61% of consumers saw higher grocery prices, and their average monthly spending went up by $61.49 starting August 2024.

Healthcare statistics show 64% of patients never compare prices, but 89% want to shop for at least one care category if given the choice. Between 33% to 52% would switch providers to get cash rebates of $25 to $100.

Behavioral economics: Self-interested vs. self-centered fairness

Traditional economic models assumed purely rational behavior. Evidence shows that fairness concerns substantially affect purchasing decisions. Self-centered inequity aversion is different from self-interested inequity aversion. Consumers react more negatively when others get better prices than when they receive preferential treatment.

Studies confirm this pattern. Letting consumers participate in price formation helps alleviate negative perceptions of price differences. Participatory pricing systems where consumers have “skin in the game” show better acceptance of price variations compared to posted-price models.

Market Dynamics That Influence Trust in Pricing

Market structure shapes how custom pricing affects trust and fairness. The relationship between coverage, costs, and data ownership determines whether customized pricing helps or hurts consumers.

High vs. low market coverage and consumer outcomes

Market coverage plays a vital role in determining customized pricing outcomes. This coverage represents how many consumers buy a product. Markets with high coverage, which usually include low-cost items that many people buy, benefit from customized pricing because it makes sellers compete more. However, niche markets with low coverage, often expensive products that fewer people buy, tend to hurt consumers. When production costs go up in a market, competition starts to look more like a monopoly.

Role of production cost in pricing fairness

Production costs affect how people see pricing fairness. People think price increases for machine-made products are less fair than similar increases for handmade items. This happens because they believe companies can control machine production costs better. Companies that explain their price changes clearly, especially when they show how costs affect prices, seem more fair to customers. Being transparent becomes even more important when prices increase significantly.

Data asymmetry and monopolistic pricing power

Companies gain substantial pricing power from information imbalance. Businesses with detailed consumer data can set individual prices that their competitors can’t match because they lack the same information. Amazon shows this advantage by changing millions of prices about every 10 minutes for each product. This difference lets dominant companies use what economists call “Bainian market power” – they can raise prices above competitive levels by controlling market conditions.

Designing Fairer Personalized Pricing Systems

Image Source: Influencer Marketing Hub

Creating ethical tailored pricing systems needs innovative approaches to balance profit goals and fairness.

Participatory pricing vs. posted pricing models

Pick-Your-Price (PYP) strategies let consumers take part in setting prices. This improves their brand perception and understanding of price causation. Pay-What-You-Want (PWYW) and Name-Your-Own-Price (NYOP) models put pricing power in customers’ hands. These models create transparency and reduce negative reactions to price differences.

Fairness-aware algorithms and pricing dispersion control

Algorithms with fairness awareness include limits on price variations between customer groups. Developers can design these algorithms to maintain both price fairness and demand fairness across groups. Our small business calculator helps determine the best pricing spread for your products.

Exchange systems to reduce unfair pricing outcomes

New exchange systems match consumers to take advantage of tailored pricing through trading. Lower-paying customers can buy goods for higher-paying ones and earn a fee. This cuts average net costs by up to 66%. Higher price differences can actually help consumers by creating checks against extreme personalization.

Group vs. individual fairness metrics in pricing models

Group fairness aims to deliver equal outcomes across demographic groups. Individual fairness makes sure similar customers get similar treatment. Meeting group fairness goals sometimes clashes with individual fairness. This happens most often when the Wasserstein distance between different groups’ attribute distributions grows large.

Conclusion

Custom pricing systems continue to alter the retail map. Their success depends on balancing profit optimization with customer trust. Our research shows how fairness perceptions substantially influence consumer responses to personalized pricing strategies. The change from fixed pricing to algorithmic models creates opportunities and challenges for businesses and consumers alike.

Market structure determines whether personalized pricing helps or hurts consumers. Custom pricing benefits consumers through boosted competition for products that many people buy. Products with low market coverage often put consumers at a disadvantage under personalized pricing strategies.

Transparency serves as the life-blood to build trust in dynamic pricing systems. People accept price differences more readily when they understand the reasons behind fluctuations. Companies generate higher fairness perceptions among customers by actively showing why prices change, especially through cost explanations that line up with reality.

Participatory pricing models provide a promising alternative to traditional posted-price systems. These models alleviate negative perceptions of price differences while maintaining profitability by giving customers a voice in the pricing process. Fairness-aware algorithms help prevent extreme personalization that damages trust by controlling pricing dispersion between customer groups.

Custom pricing doesn’t have to create distrust between businesses and consumers. Personalized pricing can create a marketplace benefiting both sides when implemented with transparency, fairness limits, and consumer participation. The development from haggling to fixed prices and back to variable pricing comes full circle—this time with potential to strengthen rather than weaken customer confidence.