PwC’s October 2025 Pulse Survey reveals that 49% of technology leaders have made AI a core part of their business strategy. These 2026 predictions indicate pricing strategies will lead the next wave of innovation.

What makes industry leaders stand out from their competitors in this new digital world? The answer comes from how businesses use pricing intelligence. Companies that implement AI-driven pricing solutions have achieved remarkable results. Their markdown revenue increased by 6.5% and overall revenue grew by 2.4%. AI-powered demand forecasting reduces prediction errors by 20-50%. These numbers represent more than just statistics – they show a transformation in successful business pricing approaches.

Smart businesses already understand AI pricing strategies for 2026. They use everything from live pricing updates to predictive modeling that spots demand changes early. Your competitive edge depends on understanding these AI 2026 trends, whether you’re new to AI or want to improve your existing technology stack.

The shift from traditional to AI-driven pricing

Image Source:Cynoteck Technology Solutions

“Traditional CPQ systems were built for a simpler world—one where product catalogs were smaller, pricing was more static, and buyers had patience for lengthy sales cycles. That world doesn’t exist anymore.” — Mobileforce Software Editorial Team, Mobileforce Software, enterprise CPQ and pricing automation provider

Retail pricing faces pressure like never before. Cost inflation, supply chain volatility, and fierce price competition have pushed traditional pricing models to their limits.

Why old pricing models are no longer enough

Traditional pricing approaches depend too much on past data, manual work, and pricing managers’ gut feelings. These create major limitations for today’s businesses. Old methods work at only 60-70% efficiency, which falls short compared to AI-driven platforms that reach 85-90% efficiency. Old pricing tools can’t respond quickly enough to market changes, which leads to delayed price updates and lost revenue.

Modern markets have become too complex for simple rule-based approaches. Smart businesses now use this complexity as an advantage through AI-powered solutions.

How AI is changing customer expectations

Amazon updates its prices about 2.5 million times each day, which sets new standards for quick pricing changes. So customer expectations have completely changed. A newer study shows that 85% of consumers prefer shopping with retailers who offer tailored prices and promotions.

Customers expect prices to match current market conditions. About 80% of shoppers are more likely to return to stores with competitive pricing. Companies without advanced pricing tools risk losing loyal customers. These expectations will grow stronger as we approach 2026.

The rise of up-to-the-minute pricing decisions

AI-powered systems watch market conditions, competitor pricing, inventory levels, and demand signals constantly. They automatically adjust prices using algorithmic strategies. This approach works well – companies using AI for dynamic pricing see 5-10% more revenue without upsetting customers.

Big retailers already show how powerful this approach can be. Target used machine learning for promotional pricing that helped boost online sales by 18% in just one quarter. Grocery chains that use AI to track competitive prices have found ways to raise prices by 20-30% on certain items without selling fewer units.

Core components of AI pricing in 2026

Image Source: Dreamstime.com

Eight critical AI pricing components have emerged that businesses need to lead the market in 2026. These interconnected elements work together differently than older systems. They create a responsive pricing ecosystem that adapts to changing conditions in milliseconds.

1. Dynamic pricing based on live data

AI revolutionizes pricing through automated adjustments that respond to current market conditions, competitor actions, and customer behavior. These systems monitor pricing signals continuously. Businesses can set optimal prices that maximize revenue while staying competitive. Companies of all sizes adjust millions of product prices daily and respond instantly to market shifts.

2. redictive modeling for demand shifts

Advanced AI does more than react to current conditions – it anticipates future demand patterns. These systems predict upcoming demand fluctuations by analyzing extensive datasets of historical sales, seasonal trends, and external factors. This foresight lets businesses adjust prices strategically before their competitors can respond.

3. Integration with inventory and supply chain

Modern AI pricing systems connect directly to inventory management and adjust prices automatically as stock levels change. Prices can increase for limited inventory during peak demand. Excess stock triggers automated markdowns. This synchronized approach optimizes both pricing and inventory flow.

4. AI-powered scenario testing and simulations

Smart businesses run sophisticated “what-if” simulations before they implement pricing changes. AI models project outcomes in different scenarios – from tariff increases to supply chain disruptions and competitor responses. This allows risk-free testing of pricing strategies.

5.Individual-specific pricing strategies

AI examines each customer’s data to deliver customized pricing based on their purchase history, browsing patterns, and price sensitivity. This goes beyond simple segmentation. It creates truly personalized offers that improve conversion rates and lifetime value.

6. Automation of promotions and markdowns

AI-driven markdown systems determine the best timing and depth for discounts. This increases sell-through rates while protecting margins. These systems design more effective future offers by analyzing past promotion performance.

7. Cross-platform pricing consistency

Companies that implement platform-agnostic AI pricing see 37% higher ROI. These systems ensure customers get uniform pricing experiences whether they shop on mobile apps, websites, or physical stores.

8. Feedback loops from customer behavior

Machine learning models refine pricing continuously by incorporating actual purchase data. This creates a self-improving system that becomes more accurate over time.

What smart businesses are doing differently

“AI monetization isn’t a bolt-on. It reshapes architecture, GTM motion, sales comp, and customer experience. From the companies we interviewed and researched, one pattern stands out: the best teams treat pricing as a system that evolves with product maturity, scales with customer value, and reinforces trust.” trust.” — Metronome Research Team, Metronome, SaaS billing and pricing platform, industry research team

Leaders in the industry stand apart from followers by their unique approach to AI pricing intelligence. Smart businesses see AI as a strategic asset that shapes market conditions, not just a reactive tool.

Using AI to influence—not just react to—demand

Smart companies create demand instead of just responding to it. They spot chances to adjust prices proactively, especially when they have products with good margins where small pricing changes bring big rewards. Studies show that these minor adjustments, often missed by traditional methods, account for more than two-thirds of pricing gains. These companies use predictive capabilities to stay profitable as market conditions change.

Building pricing strategies around customer intent

Smart businesses analyze customer intent signals rather than using generic pricing models. Microsoft’s Customer Intent Agent uses generative AI to find patterns in previous interactions. This creates an intent library that boosts conversations and helps representatives understand what customers really want. The result is more targeted pricing that matches actual customer goals instead of basic demographics.

Exploiting external signals like weather and events

The best companies feed external data into their pricing algorithms. Weather APIs blend with pricing engines to trigger automatic price changes—like raising cold medication prices during sudden cold fronts. Event intelligence platforms also help predict neighborhood- level demand surges. PredictHQ’s verified event data lets businesses adjust pricing based on

local events.

Arranging pricing with brand trust and transparency

Only 22% of consumers say they understand AI well, yet 77% feel neutral or comfortable with AI making their purchases better. B2B buyers actually prefer suppliers that use algorithmic pricing because they trust its objectivity and fairness more than negotiation- based approaches. Leading companies maintain this trust by making AI decisions transparent and highlighting benefits rather than the technology itself.

New success metrics for AI pricing strategies

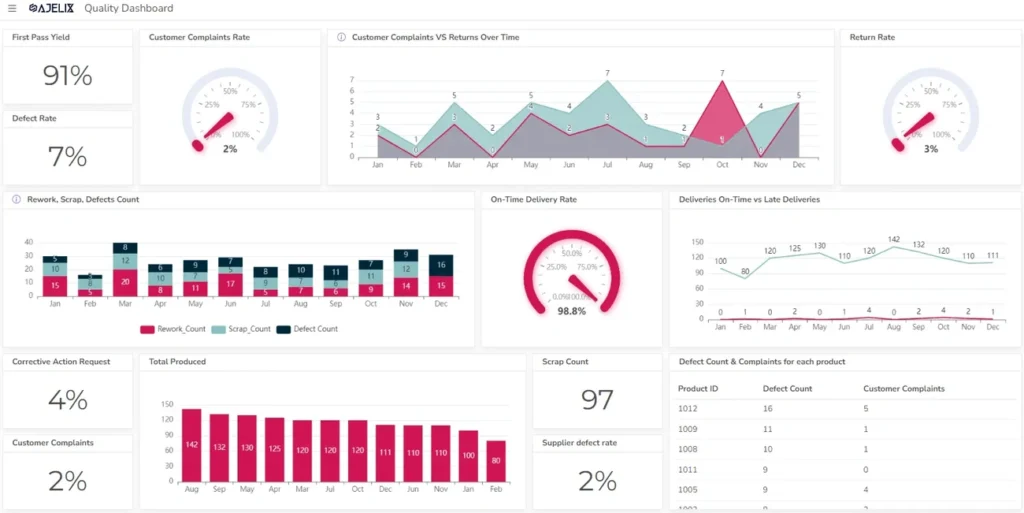

Image Source: Ajelix

Traditional KPIs no longer suffice to measure AI pricing success. Companies now adopt sophisticated frameworks that better capture their AI pricing initiatives’ business effects.

From traffic to reach: measuring visibility

Smart AI pricing strategies focus on visibility through multiple channels instead of basic traffic numbers. Companies that use advanced pricing analytics see better RGM (Revenue Growth Management) results. Their EBIT shows increases of 2% to 5% of sales. A company with $5 billion revenue could gain additional yearly profits between $100-250 million.

Cost per conversion vs. cost per click

CPC still matters, but cost per conversion stands out as 2026’s better metric. This calculation shows the true acquisition cost by dividing total ad spend by successful conversions. High click-through rates paired with poor conversion costs signal pricing misalignment that AI can fix.

Revenue per pricing decision

A small 1% price increase can boost operating profits by 8.7%, yet companies fail to optimize prices in 30% of decisions. Smart businesses now track revenue from each AI- guided pricing decision. This creates clear accountability for algorithm-driven changes.

AI pricing impact on customer retention

Customer retention metrics have become key indicators of AI pricing success. AI-powered tailored pricing looks at browsing patterns and purchase history. This approach enhances conversion rates and customer loyalty. Companies that use this method keep a healthy balance between profits and market performance. Such balance ensures steady growth through 2026.

Conclusion

AI-driven pricing is reshaping how businesses will operate in 2026. Companies that use these advanced systems have seen amazing results. Their revenue has jumped 5-10% and their forecasting accuracy improved by a lot. Staying competitive takes more than just putting AI tools in place – businesses must strategically combine live data analysis, predictive modeling, and customer-focused approaches.

The divide between market leaders and followers keeps getting bigger. Smart businesses stand out because they use AI to shape market conditions instead of just reacting to them. They study customer behavior, use external signals like weather patterns, and stay transparent. This builds trust even when their pricing algorithms get complex.

The new era needs different ways to measure success. Old metrics don’t work well when checking how effective AI pricing is. That’s why innovative companies now track channel visibility, cost per conversion, revenue per pricing decision, and how it affects customer loyalty.

The future belongs to companies that see pricing as a dynamic, AI-powered strategic asset rather than something fixed. Look at your pricing readiness now to spot gaps between what you can do today and what you’ll need to lead the market in 2026. Companies that welcome these changes will thrive in increasingly complex markets. Those stuck with old approaches risk falling hopelessly behind.