Businesses in 2025 need to strike a balance between green practices and profitability. Year after year, customers just need sustainable products and practices. Many companies still find it hard to turn this trend into profits. A fascinating gap exists – while 65 percent of consumers prefer sustainable brands, only 26 percent buy them. This creates a chance for companies that know how to close this divide.

Numbers tell a compelling story about sustainability’s business value. 33 percent of CEOs report increased revenue from their sustainability investments. Research shows most consumers would pay six percent more for sustainable products, especially when you have younger buyers. These facts challenge the old belief that green business practices hurt profits.

This piece shows you practical ways to build sustainable profits in today’s market. You’ll find ways to direct changing consumer behaviors, streamline operations, and utilize analytics to make decisions. These approaches can help your company grow financially while meeting the rising call for environmental and social responsibility.

Understand the Market Pressures in 2025

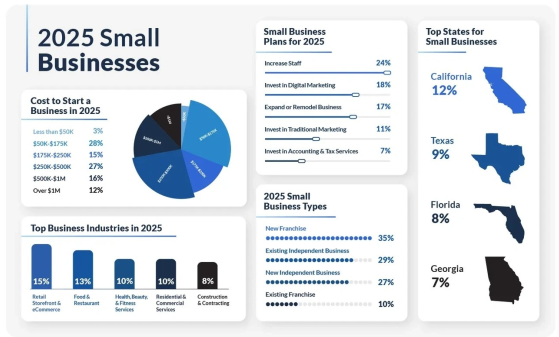

Image Source: Guidant Financial

“Without environmental sustainability, economic stability and social cohesion cannot be achieved.” — Phil Harding, Environmental campaigner and sustainability expert

Businesses in 2025 must navigate complex market pressures that create both challenges and opportunities to achieve sustainable profitability. Companies need effective business sustainability strategies that balance environmental responsibility with financial performance.

The green consumer paradox

Young consumers show this behavior even more clearly. Gen Z consumers say sustainability matters more than brand names (75%), and 81% claim they’ll pay extra for eco-friendly products. Notwithstanding that, their actual buying habits don’t match these claims.

These barriers stop consumers from buying sustainable products:

- Economic barrier: 39% of US adults think cheaper products provide better value than eco-friendly ones

- Convenience barrier: A third of consumers choose time-saving over sustainability

- Performance barrier: 20% believe eco-friendly products don’t work as well

- Knowledge barrier: 36% know which products reduce their environmental footprint

- Trust barrier: While 69% say companies should protect the environment, only 30% believe corporate climate promises

Impact of inflation and cost sensitivity

Rising living costs and inflation worries shape buying decisions in 2025. Euromonitor’s Voice of the Consumer survey shows 40% of global consumers see high prices as their biggest roadblock to buying sustainable products.

Companies must tackle this price sensitivity head-on. Research shows people will pay 9.7% more for sustainable products. Some categories see even bigger markups – sustainability-marketed products cost 26.6% more overall, and paper products cost double.

Smart pricing strategies are a vital part of success. Product claims that highlight health benefits, cost savings, and local community support attract more buyers. Scientific claims about biodegradability or climate neutrality don’t work as well.

New sustainability regulations (CSRD, EUDR)

Regulatory compliance has become central to business sustainability practices in 2025. The Corporate Sustainability Reporting Directive (CSRD) brings a fundamental change as companies publish their first reports under these rules. This directive requires detailed disclosures about sustainability impacts, risks, and opportunities.

The EU has responded to regulatory burden concerns with an Omnibus simplification package that cuts administrative costs by €6.3 billion. This package removes about 80% of previously included companies from CSRD’s scope.

Global harmonization in sustainability reporting continues to gain momentum. The directive uses “double materiality,” which means companies must show how sustainability issues affect their business and how their operations affect sustainability.

Smart companies turn compliance into competitive advantage. They accept new ideas instead of seeing regulations as burdens, and blend sustainability into their core business model. This approach creates both environmental and financial benefits.

Adapt to Changing Consumer Behavior

Consumer behavior around sustainability is both a chance and challenge for businesses in 2025. Knowing how people behave helps you create strategies that work to close the gap between what consumers say and what they actually do.

Why intent doesn’t always lead to action

The data shows a clear gap between what consumers plan to do and their actual buying habits. Studies show that while 85% of consumers have moved toward more sustainable purchasing over the last several years, only 26% spend their money this way when making purchase decisions. This behavior, which experts call the “green gap,” creates a tough environment for businesses that invest in sustainable products.

Several barriers stop consumers from acting on their green values:

- Economic concerns: 44% of consumers say price stops them from buying sustainable products

- Convenience factors: Time limits and product availability stop even committed buyers

- Knowledge deficit: Many buyers don’t know how to spot truly sustainable options

- Trust issues: 48% of people say they “sometimes” trust what brands claim about sustainability, based on messaging and reputation

The situation gets tougher during economic uncertainty. People put their money concerns ahead of environmental ones. About 79% of surveyed consumers buy cheaper products but don’t necessarily buy less. They look for deals or wait longer to buy.

How to arrange pricing with sustainable value

Your pricing strategy must show the real value of sustainable products to overcome these barriers. Value-based pricing works best for sustainability products – it captures what customers will pay based on the benefits they notice.

Start by finding comparison points for your pricing models. Look at your product category, alternative options, and sustainability costs. This helps you justify higher prices while staying competitive.

Products that are sensitive to price changes, especially those for budget-conscious buyers, might need lower initial prices. This helps build demand before moving to value-based pricing once sales stabilize.

Don’t forget to download our small business pricing calculator

keeping good profit margins.

Targeting younger, eco-conscious demographics

Young people are your best market for sustainable products. Gen Z spending grows twice as fast as older generations did at their age. They will spend more than baby boomers globally by 2029. By 2035, Gen Z will add $8.90 trillion to the global economy.

The numbers tell an interesting story – 75% of Gen Z buyers prefer sustainable products over brand names. It also works for Millennials, where 84% say sustainability matters in their buying choices.

These groups shop differently than others:

- They spend more and take on debt despite money worries

- More than a quarter use buy-now-pay-later options

- They want honest information – 61% say recycled content or packaging matters most

- They’ll pay extra for convenience, with 40% spending more on green shipping

Redesign Operations for Sustainable Profitability

Businesses can achieve their sustainability goals and maintain profit margins through operational redesign. Companies that reimagine their operations find that environmental and financial goals support each other rather than compete.

Streamline supply chains for efficiency

Supply chain management is the life-blood of sustainable operations. Your bottom line improves when you work closely with suppliers who prioritize environmental responsibility. Supply chains generate up to 11.4 times a company’s direct emissions—more than 90% of total greenhouse gas emissions.

Several key strategies help streamline supply chains:

- Implementing ethical sourcing practices

- Optimizing inventory management to reduce waste

- Consolidating shipments to minimize transportation emissions

- Adopting circular economy principles that focus on recycling and reuse

Reduce waste through better forecasting

Better forecasting capabilities give businesses a unique chance to reduce waste and boost profitability. The Food and Agriculture Organization reports that 40% of total food production gets wasted before reaching the market. These numbers show significant room for improvement.

AI-powered forecasting tools predict demand with impressive accuracy. To name just one example, a major online

grocery retailer specializing in fresh foods reduced food waste and spoilage by 49% after using AI-driven demand

forecasting. A leading regional supermarket chain also cut spoilage by 20% in fresh items and 10% overall with

improved forecasting.

These systems analyze various data sources:

- Internal company data

- Retail customer information

- External factors like weather patterns

- Market trends and seasonality

Automation technologies help businesses achieve carbon neutrality. Accenture and the World Economic Forum’s analysis suggests that digital technologies could reduce emissions by up to 20% by 2050 across industries.

Automation brings multiple sustainability benefits. The technology optimizes energy use through better process control and equipment monitoring. Real-time energy usage measurements help identify operational inefficiencies. Precise inventory control reduces overstocking and stockouts that create waste.

Operational redesign proves to be more than an environmental initiative—it’s a strategic business move. Companies that welcome these approaches gain immediate cost savings and long-term competitive advantages in a marketplace that increasingly values sustainability.

Use Data and Tools to Drive Smarter Decisions

Data is the life-blood of business success in today’s market. Companies that control information well can advance environmental goals and boost profitability through smarter decisions.

Set up sustainability tracking systems

Good sustainability management needs reliable tracking systems to collect, analyze, and use operational data. These platforms help you spot inefficiencies, track progress, and prove compliance with tougher regulations. Data-driven sustainability reduces human error and energy waste while meeting environmental targets.

Key sustainability tracking solutions provide these benefits:

- Centralized data management combines sustainability information on a single platform. This eliminates scattered data and ensures consistent, updated information across departments

- Automated data collection makes reporting easier and more accurate by creating a single source of truth

- Live monitoring helps quickly spot system failures and stop waste promptly

These systems produce clear results. IIoT monitoring solutions that send information to relevant employees have improved productivity by 24%. Companies using advanced tracking tools have cut energy-related emissions by up to 24%.

Use the margin growth accelerator

The Sustainable Profitable Growth Algorithm gives a complete view of integrated commercial investments. This helps identify trade-offs needed for both top and bottom-line growth. This approach matters because commercial investment takes over 50% of consumer price, including advertising, trade discounts, and promotional funding.

Half of these funds end up misallocated because of poor visibility, tactical rather than strategic decisions, and short term thinking. A margin growth accelerator helps maximize returns from commercial investments—whether cutting back or choosing where extra funds will create more value.

Match commercial strategy with sustainability goals

Success in today’s market requires embedding sustainability goals into corporate objectives that match stakeholder expectations. These goals should connect to business KPIs to drive long-term financial and environmental performance.

The matching process needs:

- Clear, measurable sustainability targets based on thorough data analysis

- Regular progress monitoring using key performance indicators

- Investment in technology that measures and tracks sustainability efforts

Future-Proof Your Business Model

“Progress is impossible without change, and those who cannot change their minds cannot change anything.”

— George Bernard Shaw, Nobel Prize-winning playwright and critic

Successful organizations in 2025 see sustainability as a competitive advantage rather than a side issue. Global economies could lose 19% of their income by 2049 because of past emissions. This equals a 17% drop in global GDP. These numbers show why businesses must include sustainability in their business model to survive long-term.

Reinvent value creation and delivery

Smart companies do more than just comply with sustainability rules – they make it part of their strategy. Companies that blend sustainability with strategy create new ways to compete and generate lasting value. Your business can create a better value model by reviewing your strategy chain. This helps you map your business model and find ways sustainability can add value.

The Sustainable Business Model Innovation (SBM-I) approach works well. Companies that use this framework make three times more organizational changes that reflect sustainability goals. The core team’s objectives must line up with environmental goals, which many businesses struggle with.

Build resilience through sustainability

A strong business in 2025 shows four main strengths. These include secure supply chains through ethical sourcing, stable energy through efficiency and renewables, solid reputation through transparency, and talent attraction by matching employee values. Companies must utilize sustainability’s benefits to protect their future operations.

Your business should run an ESG risk audit to spot potential environmental, social, or governance risks. You need to set and monitor resilience KPIs that track emissions, supplier diversity, and employee participation. A clear roadmap with achievable targets helps embed sustainability into business strategy and maximizes competitive edge.

Turn compliance into competitive advantage

The Corporate Sustainability Reporting Directive (CSRD) creates opportunities to stand out. Companies can gain an edge by using phase-in periods as practice runs. This shows stakeholders that sustainability runs deep in their strategy instead of just surface-level changes. Companies that take a strategic view of sustainability requirements can get:

- Better loan terms and easier access to capital through higher ESG ratings

- Better brand value and reputation protection

- Tax benefits, incentives, and special financing options for investment

Conclusion

The business world of 2025 shows how sustainability and profitability work together, not against each other. Companies that become skilled at this balance get most important competitive edges by cutting operational costs, boosting brand reputation, and reaching growing eco-conscious markets. Smart businesses see the gap between what consumers say and do as a chance to distinguish themselves with genuine sustainable value propositions.

Redesigning operations strategically offers maybe even the most direct path to reach environmental goals and healthy profits. Supply chain improvements, waste reduction through better forecasting, and targeted automation can cut both costs and emissions. Analytical insights are the foundations of these efforts that let you track progress, spot inefficiencies, and show real results to stakeholders.

Making your business future-proof means putting sustainability at the heart of your strategy instead of treating it as an afterthought. This helps you turn regulatory compliance into a competitive edge while building resilience against ESG risks that could threaten your long-term success.

Successful organizations know that strategic pricing is a vital part of this equation. Consumers say they’ll pay more for sustainable products, but your pricing strategy must show value while staying aware of economic pressures. The right pricing drives both adoption and profits.

Your business just needs a complete look at how sustainability fits your business model. Take time to review your

current pricing strategy and find places where green initiatives can boost your profit margins. Companies that move

now will succeed in a market where environmental responsibility and financial success go hand in hand.